Waikato introduces first fintech degree

The rapidly growing fintech sector generates $1.8 billion in export earnings for the country.

Now students aspiring to work in the sector can complete a dedicated qualification in fintech, with the University of Waikato’s management school introducing the country’s first Bachelor of Banking, Finance & Technology (BBFinTech) degree. The first cohort of students will start their studies from next year.

“The world of finance runs on digital technology. From investment platforms and digital currencies to the way we make payments, nothing happens without digital,” says Matt Bolger

Pro Vice-Chancellor for the Waikato Management School.

“Yet no undergraduate degree in New Zealand currently recognises the need for these dual competencies.”

He sees the BBFinTech filling a critical skills gap that could hold back one of the fastest-growing and highest paying sectors of tech.

The Tech Investment Network’s 2022 Fintech insights report found that the fintech sector had a five-year compound annual revenue growth rate of 32%, which is three times the five-year average of the TIN200 tech companies that are tracked.

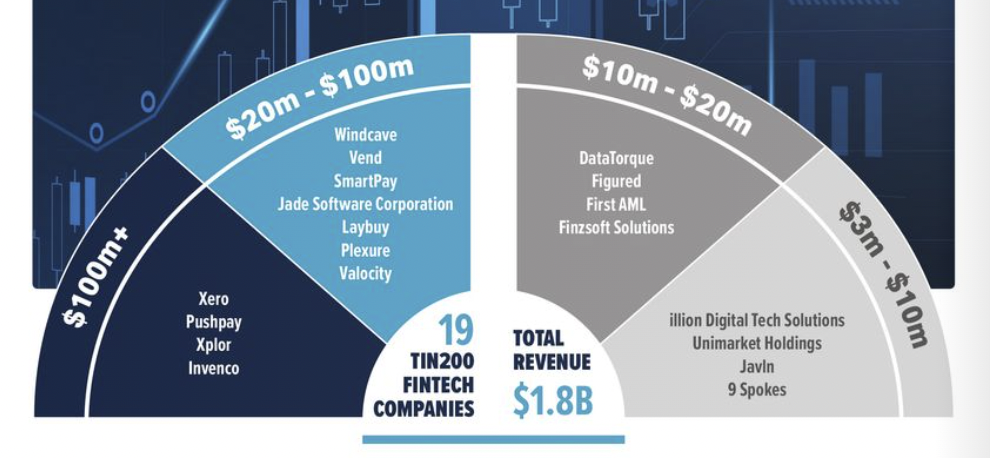

Source: TIN Fintech Insights Report

There were 19 Fintech companies in the TIN200 rankings in 2021 and between them, they generated a combined $1.8 billion in revenue, or 13.1% of the total TIN200 revenue. The sector’s growth in 2021 was $358.7 million; a 25% increase from the previous year.

The average salary in the fintech sector is $103,000. So a dedicated qualification in fintech will help create a career pathway into the sector. Several Australian universities currently offer bachelor's and master's degrees in fintech.

“We’re expecting this area to snowball,” says Shane Marsh, founder of leading fintech innovator Dosh and University of Waikato alumni.

Source: TIN Fintech Insights Report 2022

“There is a real need for people with fintech skills who can help shape the future of financial services. We need people who understand how open banking, digital currencies, and emerging technology will define the future solutions we want in New Zealand and overseas,” he adds.

The BBFinTech degree will cover areas including financial markets, investment platforms, digital finance, banking operations, automated trading, blockchains, cryptocurrencies, cyber security, and more, says Bolger.